Segregated funds combine the growth potential of investment funds with insurance protection.

Segregated (or seg) funds are an investment product sold by life insurance companies. They are individual insurance contracts that invest in one or more underlying assets, such as a mutual fund.

Unlike mutual funds, segregated funds provide a guarantee to protect part of the money you invest (75% to 100%). Even if the underlying fund loses money, you are guaranteed to get back some or all of your principal investment. But you have to hold your investment for a certain length of time (usually 10 years) to benefit from the guarantee. And you pay an additional fee for this insurance protection.

WARNING

If you cash out before the maturity date, the guarantee won’t apply. You’ll get the current market value of your investment, less any fees. This may be more or less than what you originally invested.

3 advantages of segregated funds

- Principal guaranteed– Depending on the contract, 75% to 100% of your principal investment is guaranteed if you hold your fund for a certain length of time (usually 10 years). If the fund value rises, some segregated funds also let you “reset” the guaranteed amount to this higher value – but this will also reset the length of time that you must hold the fund (usually 10 years from date of reset).

- Guaranteed death benefit– Depending on the contract, your beneficiaries will receive 75% to 100% of your contributions tax free when you die. This amount is not subject to probate fees if your beneficiaries are named in the contract.

- Potential creditor protection– This is a key feature for business owners in particular.

ESTATE PLANNING WITH SEGREGATED FUNDS

The Equitable Life Investment Advantage

When you invest with Equitable Life, you are entitle to features taht protect your investment throughout your life, and assist in the efficient transfer of assets when you pass away. Many of these features are unique to insurance investments, and may not be available in a traditional mutual fund. These features include:

- Maturity and death benefit guarantee options to protect your investment

- Bypass probate and associated fees by naming a beneficiaiary

- No early redemption fees at death

- Quick payment to beneficiaries after you pass away

- Private and confidential beneficiary designations

- Creditor protection may be available in the event of bankruptcy or lawsuit

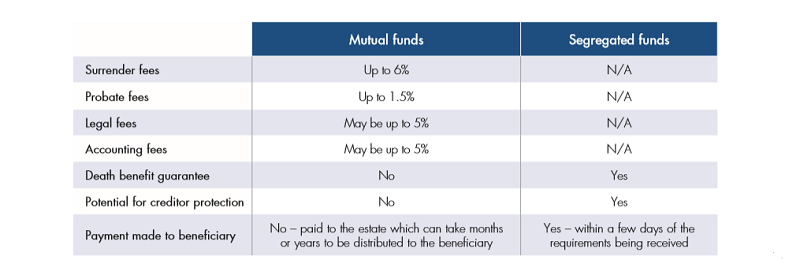

Mutual Funds versus Segregated Funds

While mutual funds and segregated funds share many similarities, segregated funds have unique estate planning advantages because they allow a beneficiary to be named on a non-registered investment. Unlike mutual funds, the investment proceeds are paid directly to the named beneficiary(ies), bypassing the administrative costs associated with the estate settlement process.